Case Study

Tier 1 European Bank

Facing the challenge of meeting digital-savvy customers’ demands in a competitive banking landscape, a Tier 1 European Bank collaborated with NTT DATA.

Together, they developed a solution integrating payment initiation services into the bank’s infrastructure, transforming digital banking through web and mobile channels.

Addressing the Challenge of Increasingly Digital Customers

The demand for digital solutions and experiences is surging as more customers embrace digital platforms. In this highly competitive landscape, the key to success lies in blending expertise with agility to swiftly deploy digital financial initiatives that cater to customer needs.

To establish itself as a leader in this dynamic environment, this bank aimed to adopt a cutting-edge solution for the Payment Initiation Service (PIS). PIS is a regulated service that facilitates authorized payments by transferring funds between accounts, either within the same bank or across different banks.

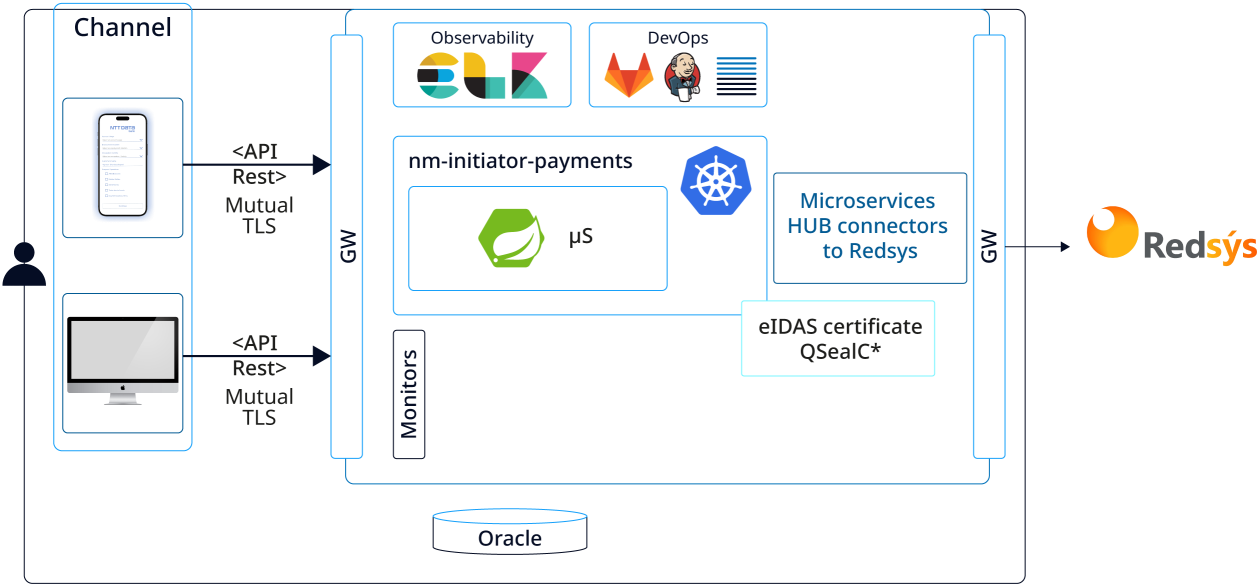

The bank planned to implement a solution that would allow customers to initiate transfers from their aggregated accounts across various institutions via digital channels. For this purpose, it sought to integrate Redsys as a HUB for payment initiation in Spain.

A Solution to Enable New Digital Channels

NTT DATA has extensive experience in developing digital solutions and integrating agile third-party providers.

In the process of building the Platea’s API HUB, several connectors were developed for payment initiation, including one for Redsys.

Leveraging its deep understanding of the TPP integration process, NTT DATA addressed the immediate challenges faced by the bank and crafted a solution that not only resolves current challenges but also paves the way for future challenges with other thirds parties providers.

NTT DATA suggested a strategy that capitalizes on the bank’s existing on-premises infrastructure, making optimal use of its current architectural framework and server resources.

Technical Architecture

A Future-Proof Outcome

As a result of NTT DATA’s expertise, the bank is now equipped to provide comprehensive multichannel payment integration.

This solution effectively utilizes the bank’s existing architecture and extends across both web and mobile channels.

With these advancements, the bank is well-prepared with the capability to initiate payments across various banking institutions.