Composable Banking

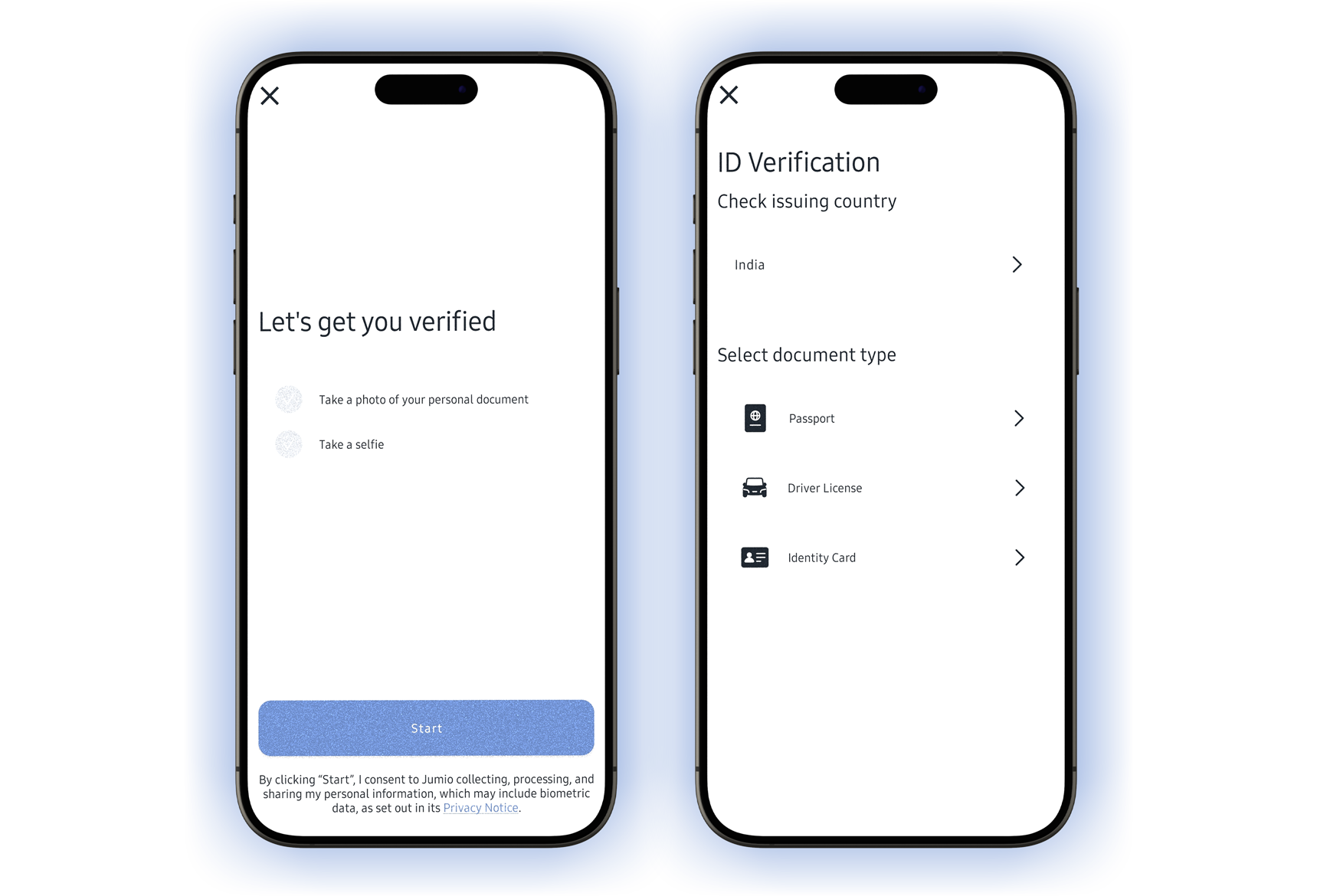

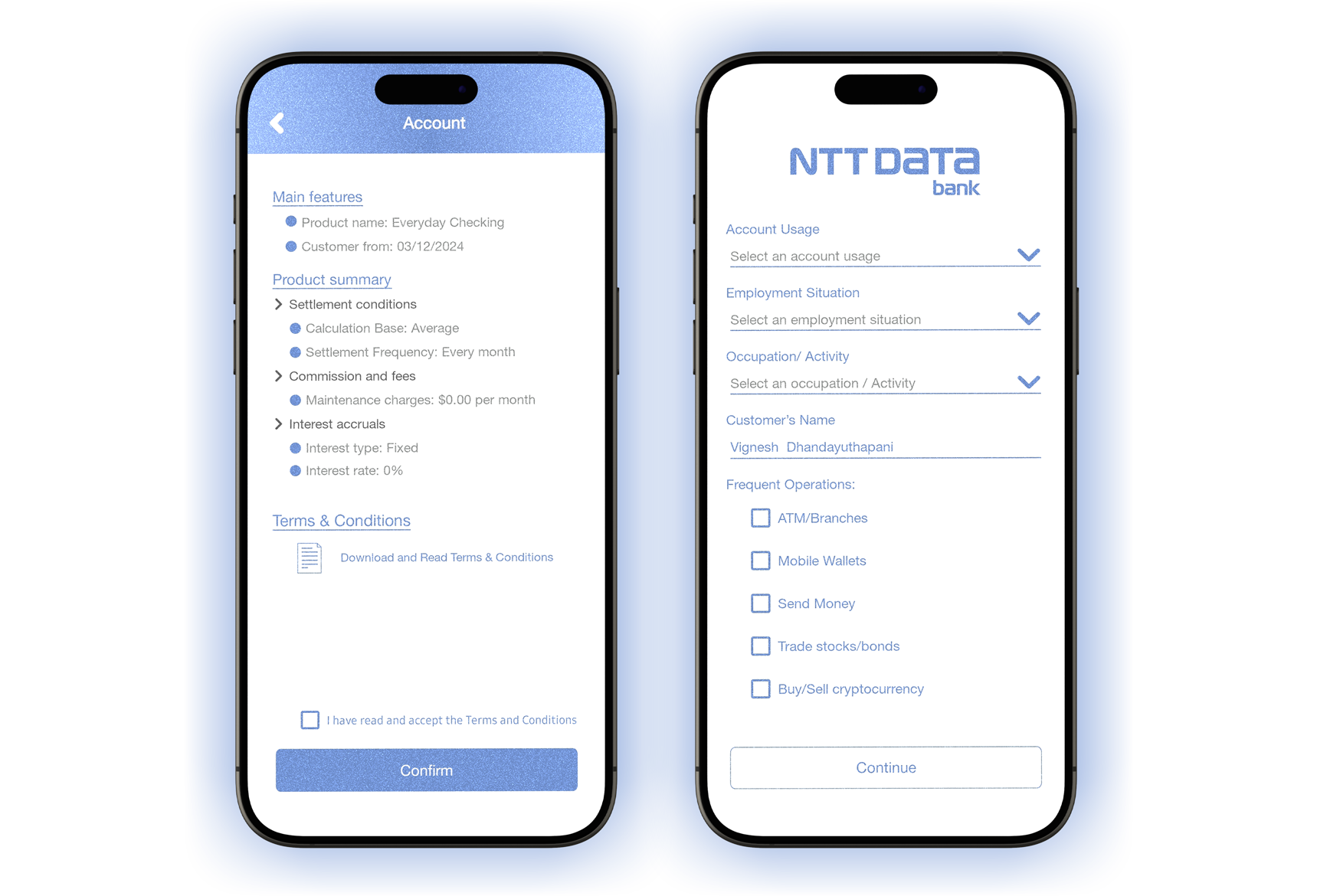

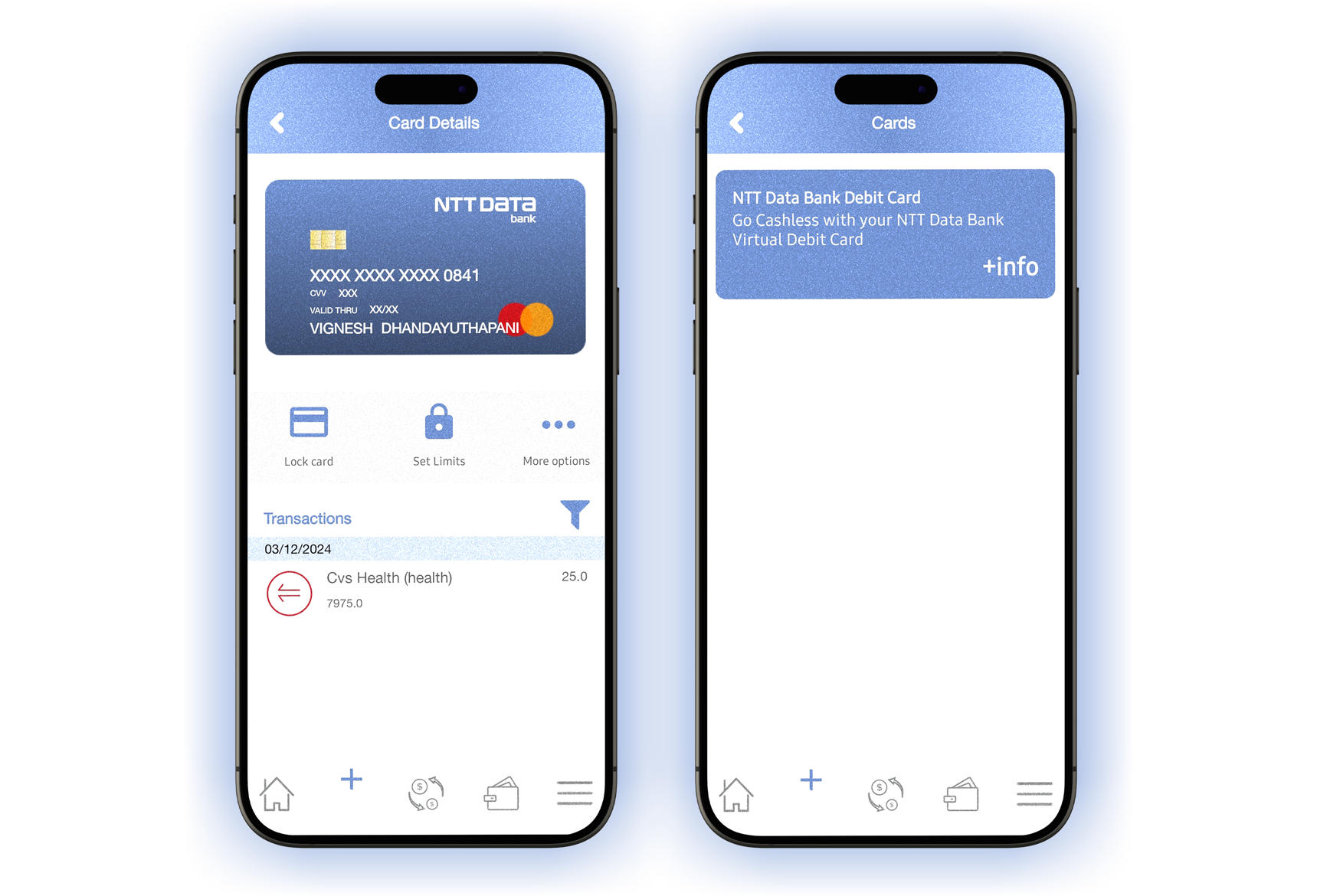

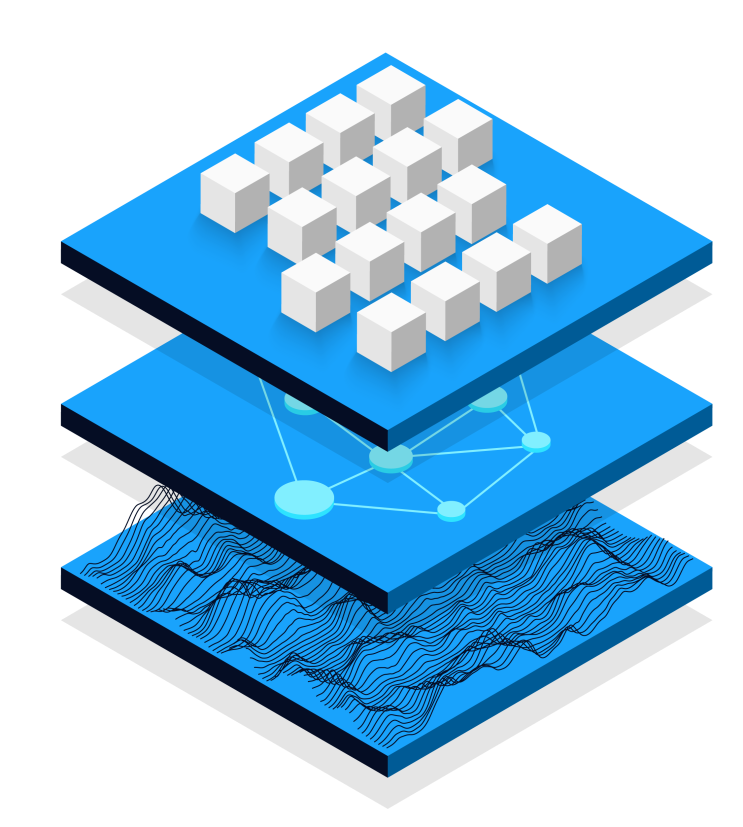

Composable Banking About Composable Banking Composable banking is a modern approach to banking technology that leverages modular, flexible components to create adaptable financial services. It allows banks and financial institutions to assemble, reassemble, and scale banking operations and customer offerings with unprecedented agility. Imagine it as building with blocks, where each block represents a specific…