Case Study

Global Insurer

In response to PSD2 enabling bank customers in Europe to share account data with licensed third parties, an insurance company faced the challenge of integrating this capability into its onboarding process to enhance offerings.

Partnering with NTT DATA, it leveraged Platea for a low code, cost-effective solution, facilitating quick, easy integration with TINK.

This initiative allowed the company to generate detailed reports for customers post-consent, detailing income, expenses, and savings opportunities, thus positioning the customer for success in an open financial market and encouraging savings through targeted products and services.

Addressing the Opportunity that came with Open Banking

The implementation of PSD2 in Europe has enabled bank customers to securely and conveniently share their account data with authorized third parties, upon giving their consent. This regulation has ushered in a new breed of products and services offered by innovative companies to help consumers and businesses better manage their money and understand their finances more easily and securely.

Insurance companies, as well as some online lenders, have the ability to leverage customer account information to enrich their onboarding process and streamline their offerings. This access to bank accounts can be done either by the insurer applying for an account information licence or by using a licensed third party to obtain insights from customer accounts to assist them in the onboarding process.

In this case study, the insurance company was looking to add value to its customers by helping them understand their income and expenses over time, month by month, including the categorisation of spending. By analysing their account information, the insurance company could suggest savings through products and services offered by companies it collaborates with.

A Solution that Integrates Open Banking at Reduced Cost

NTT DATA brings the necessary experience building digital solutions with third-party integration initiatives in the PSD2/Open Banking domain.

NTT DATA proposed a solution based on Platea’s Open Banking module to accelerate the initiative. This module consists of a low code solution for the design and development of the customer experience solution combined with a module to integrate with TINK and provide the functionality to the customer quickly, easily, and at a reduced cost.

The combination positioned the customer favorably against an increasingly open financial market where choosing the right technology and strategies is fundamental to succeed.

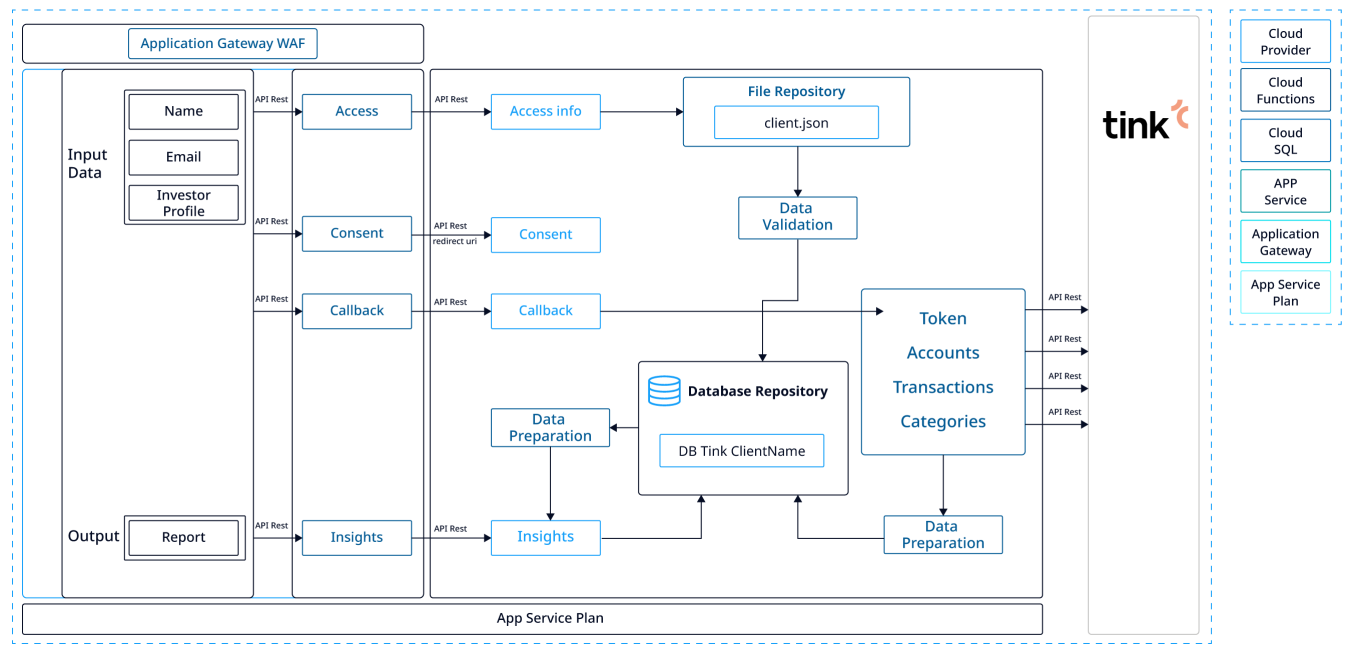

Technical Architecture

A Integrated Outcome to Benefit the End-Customer

Through partnering with NTT DATA, this insurer was able to integrate the third-party solution provided by TINK into its existing architecture and server estate.

For the insurer’s end-customers, the process has minimal friction. All they need to do is complete a simple onboarding process that give consent for the insurer to access his or her account information.

Once completed, the end-customer benefits through enhanced services. They gain reports with aggregated account information for better visibility of their spending, and start receiving offers to start saving.